Market Update: Cash Versus Loan Sales Mid-Valley

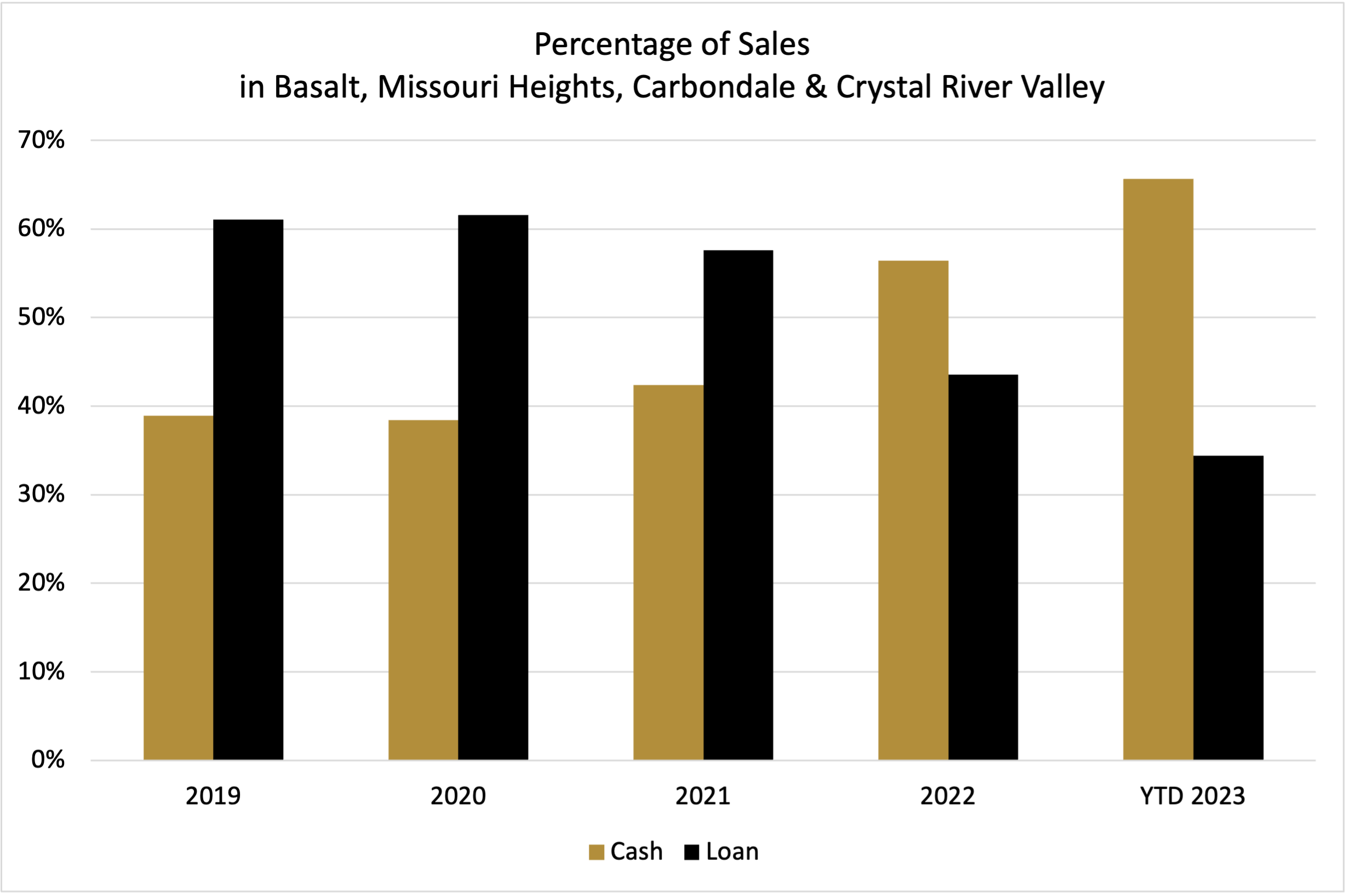

A recent company sales meeting brought up the question of whether we are seeing more cash sales now that interest rates have risen, so I decided to investigate. Below you'll find a chart outlining the percentage of Mid-Valley sales that were cash vs loans since 2019. In 2019, 2020 and 2021, there was about a 40/60 split between cash/loan sales. In 2022, that flipped, with 56% cash sales and 44% loan sales. So far this year, that trend is continuing with 66% cash sales and 34% loan sales. Unless interest rates drop this year, I suspect that we'll end the year with an even higher percentage of cash sales (perhaps something like 70/30).

To provide more perspective: last year, Aspen had 90% cash, 10% loans; Snowmass Village had 76% cash and 24% loans; Glenwood Springs is on the other end of the spectrum with 33% cash and 67% loans. The Mid-Valley area sits right in the middle of that up-valley versus down valley spectrum.

The Roaring Fork Valley is unique in that unlike urban areas, our higher home values attract higher-end clientele who are able to pay cash for homes instead of financing. Overall, we brokers speculate if that means that more homeowners here have more staying power if the economy takes a turn, because there are (in theory) more fully owned homes than bank-owned. That puts less stress on local homeowners to sell for economic reasons and might explain why we have such little inventory compared to other areas in the country. In other words, more staying power in our area means a stronger return on your investment long-term. I'll be researching that more in my next newsletter!

Year-to-date sales in Basalt, Missouri Heights, Carbondale and the Crystal River Valley are right on pace with sales last year. Despite the change in buyer demographics, there have been 32 total residential sales in these areas so far this year; there were 31 last year. This could mean that prices could remain stable (and high!) for a little while longer. It may take a few more years for values to drop significantly, if they do.

Below is the year-end 2022 Mid-Valley Market Report - please have a look for more details!